We Have The Financial Know-How You Need For Your Capital Funding Solutions.

Here are some of the products and services we offer.New Product--Top Tier Financing

Private Syndicate Lines of Credit

Business Lines of Credit

Term Loans

Personal Loans

Accounts Receivable Financing

Non Profit Funding

Working Capital Loans

Bridge Financing

SBA 7(a) Loans

Franchise Funding

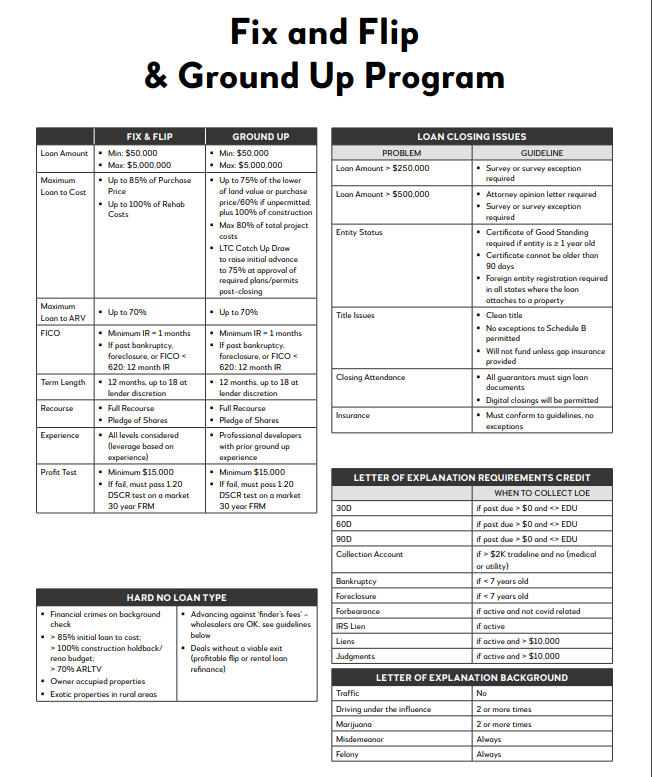

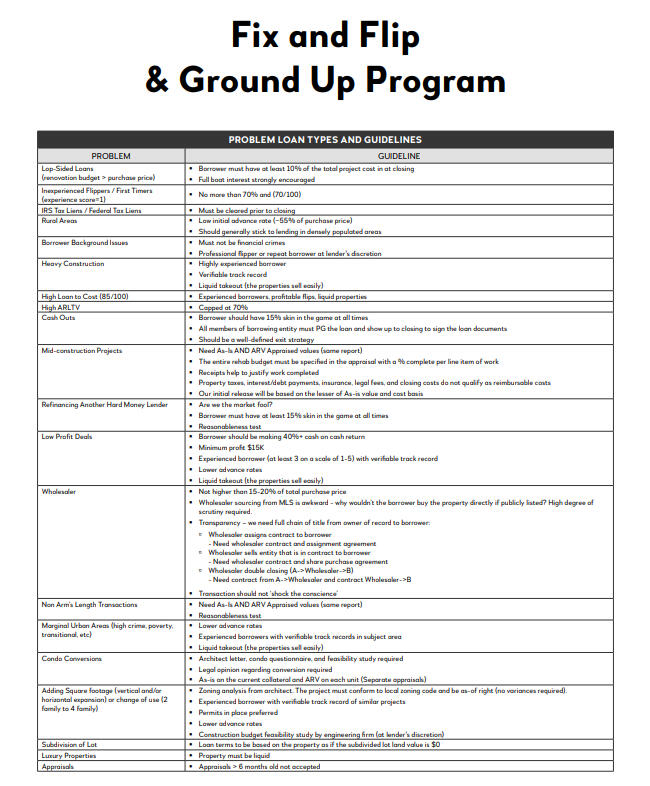

Fix & Flip and Ground Up Construction

Merchant Cash Advance

Invoice Factoring

Commercial Loans

Equipment Financing

Mixed Use-Industrial Loans

Start-Up Financing

Flex Space Loans

Private & Venture Funding

Reverse Consolidation Loans

Heavy Machinery Funding

Hotel/Motel Financing

Warehouse Loans

Medical Equipment Financing**We are not tax advisors or CPAs. Talk to a CPA in your state to confirm tax status.

Working Capital

What Your Bank Will NEVER Tell You About Business Lending … Get Insider Knowledge Right Here …

Does your business need a loan?

The business lending world can be complex but we can help guide you in the right direction! Find the best options out there for your business. There might be options you’ve never heard of.

Working capital when you need it

Multiple Finance Options All In One PlaceYour Finance Officer will help you find and understand what funding you qualify for right now from thousands of sources that we work with directly. They will even help you work with a Business Credit Team to help get your business approved!Here are 2 of our most popular programs for growing businesses:

Merchant Cash Advance

Lending GuidelinesMinimum Criteria■ 4 months in business

■ $25,000 revenue PER MONTH for the last 6 months

■ Max overdrawn days allowed: 7

■ 4-6 income deposits each month

■ Current 4 months of business bank statementsTerms and Conditions■ Funding amounts: $25,000 - $15,000,000

■ Repayment Types: daily, weekly, bi-weekly, monthly, bi-monthly

■ Payment types: ACH

■ Repayment duration: 3-36 month

■ Tax liens: OK

■ Past bankruptcy: OK if discharged or dismissedGeneral Information■ No minimum FICO score

■ Credit pull: soft

■ No cost to apply

■ Most loan products are UNSECURED, with the exception of equipment loans

■ No collateral required

■ Full suite of over 20 financial lending products available

■ Revenue and credit based products available

■ Home-based, online, LLC, sole-proprietorship, and partnership: OK

■ High risk: OK (Transportation, grow house, etc)

■ Citizenship: USA (Permanent residents considered.. up to $50K max)

■ Business must be US based

■ No industry restrictions

■ Loan positions we fund: 1st-6th

■ DocuSign contracts available

■ Available in all 50 states

■ Businesses must be able to handle multiple payments to us each month

■ Robust cash flow required with no credit score

■ The expense (Interest or factor rate) of the loan is a tax write-offEquipment FinancingWe know what entrepreneurs value the most in the equipment financing space. That's why we now offer a boutique financing arm of our company, the equivalent to that of a large scale firm.Equipment financing refers to a loan used to purchase business-related equipment, such as a restaurant oven, vehicle or copy machine.When you take out an equipment loan, you'll make periodic payments that include principal and interest, over a fixed length of time.Serial numbers, vendor purchase orders, quotes and photos of the equipment you're purchasing are required prior to funding and the equipment you purchase will be used as collateral for the loan.Additional information/ advantages of our equipment loans:

* 60 month terms available

* Favorable approval rates on complex industries

* Customized programs available for clients with A-F credit

* Hassle free application process.

* Funding amounts from $20,000 - $5,000,000

* Qualified Industries: Medical, Dental, Excavation, Restaurant, Manufacturing, Automotive

* Competitive "bank-type" rates for A+ credit: starting at 7.50%

* Same-day funding available

* Access first-to-market products and a competitive advantage

* Equipment loans are typically managed and serviced in-houseFor our preferred industries, we can offer low down payment programs which are determined by the quality of the equipment and strength of the business.Below is a sample list of equipment available for finance:

* Restaurant equipment

* Heavy Machinery

* Green tech equipment

* Commercial, Garbage, Box Trucks

* Construction Equipment

* Manufacturing and Retail Equipment

* Hospital and Dentistry Equipment

* Medical

* Logging

* Woodworking

banks only lend when you don't need the money

If you’re ready to grow your company, getting a small business loan could be a smart option. While many types of loans are available, most will require strong personal and business credit scores, reliable cash flow and, ideally, a couple of years of business history. Traditional sources of financing are cumbersome, time consuming and ultimately, 89% of all applications are declined by banks.If you’re still building your business credit or growing revenue, there are better options to get cash quickly, including merchant cash advances, invoice factoring and invoice financing. You can also look into bad credit business loans, which target business owners with a personal FICO score of 630 or below.

creative solutions to drive your business to the stars

Our network of business lender sources is one of the largest in the industry. We’ll help you find the most optimal funding options for your unique situation.

Check out our Business Credit Builder Program, the most comprehensive program available, designed to position your business to obtain the credit you need when you need it.

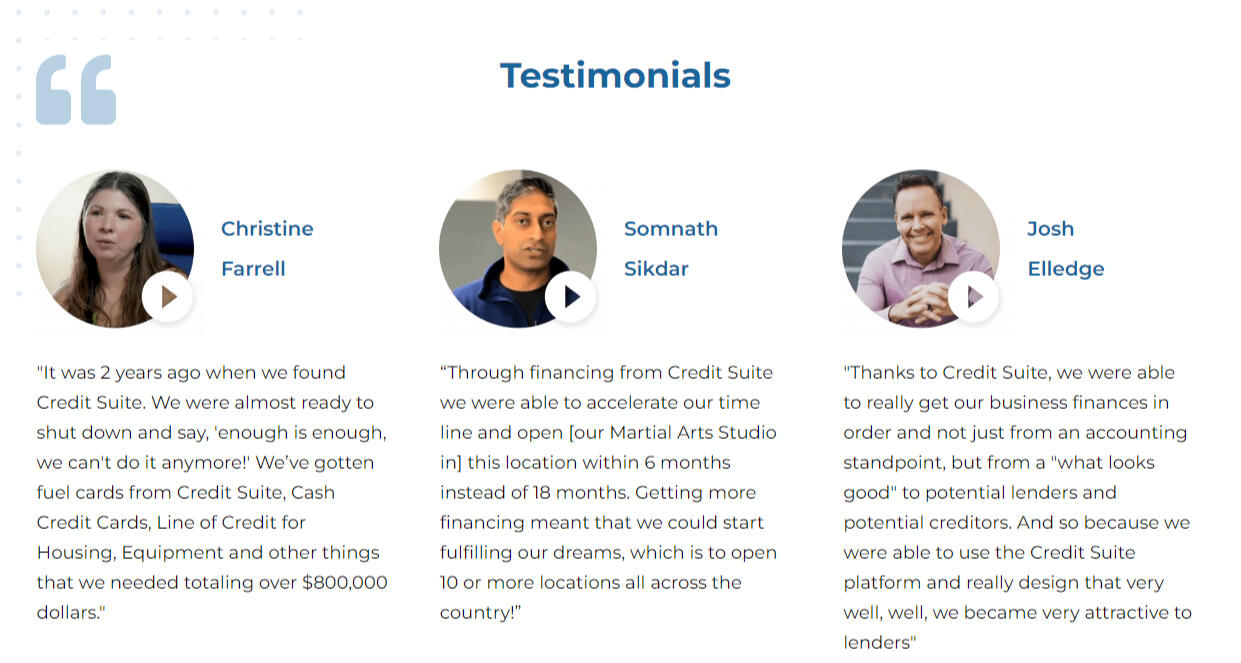

Watch the video below for details.

Video Testimonial from

Edward Araujo, Texas

Restaurant Business Loan in

Alaska Funded.$171,000.00 In 31 hours start to finish. Owners both had bad credit and did not qualify with their bank or their credit union.

08-21-23

Landscaping Company

Business LoanAnn's husband owns an Oklahoma land-scaping company, and works his books at night. Ann knows all about banks' oft-unwillingness to support the Latino community, so she reached out to us, and we were able to help.

08-26-23

Bowling Alley Business LoanSame old story... Their bank chose not to lend to them, even though they'd been with the bank 27 years! All because the business owners missed a house payment during COVID-19! The loan officer who calls himself the "MONEY MAN THAT CAN" he was able to get this closed in less than 3 days start to finish!

07-14-23

Wine Bar Business LoanThis wine bar was approved for $930,000.00 but decided to borrow $700,000.00 for now, as they are expanding, and if need be will take the remainder in the coming months.

05-27-23

Golf Course Business LoanWe came through again, and came through big!!! $550,000.00 funding for an East Coast golf course. Our client could not get a loan through their bank as he had not filed his tax returns for his business in the last two years.

06-28-23

Healthcare Facility Business LoanThis dentist was in dire need of cash as COVID-19 almost gutted his nest egg which he used to keep his employees on board during COVID even though sales were down over 80% two years in a row. Because he stepped up and did the right thing by his staff, their bank would not lend to them because they didn't have enough savings as collateral. We were able to step in and prescribe the right medicine needed to keep this business healthy.

07-28-23

PRIVATE SYNDICATE LOC GUIDELINES*$30,000 MIN TO $100,000 MAX*ZERO PERCENT INTEREST CHARGE FOR 12 MONTHS. (IN LIMITED CASES WITH 735 FICO OR BETTER, ZERO INTEREST FOR 24 MONTHS)*680 EXPERIAN FICO SCORE (679 AND BELOW IS AUTO DECLINED)*NO MINIMUM TIME IN BUSINESS-NO INDUSTRY RESTRICTIONS EXCEPT GUN SHOPS*NO OUTSTANDING CHARGE OFFS ON CREDIT*MUST HAVE 1 YEAR OF CREDIT HISTORY*NO MORE THAN 4 CREDIT INQUIRIES IN THE PAST 6 MONTHS*NO REVENUE REQUIREMENTS*TAKES 2 TO 4 DAYS FOR FUNDING*INTEREST RATE IS BETWEEN 9% AND 14% AFTER FIRST 12 MONTHS*BANKRUPTCY MUST BE DISCHARGED OVER 10 YEARS AGO*NO MERCHANT CASH ADVANCES, BUSINESS LINES OF CREDIT, TERM LOAN DEFAULTS EVER*ZERO FELONIES AND NO MORE THAN 3 QUALIFYING MISDEMEANORS IN THE PAST 2 YEARS*MUST BE A US CITIZENTHE BROKER AND CLIENT MUST SIGN AN NDA & NON-CIRCUMVENT AGREEMENT.

Merchant Cash Advance

Lending GuidelinesMinimum Criteria■ 4 months in business

■ $25,000 revenue PER MONTH for the last 6 months

■ Max overdrawn days allowed: 7

■ 4-6 income deposits each month

■ Current 4 months of business bank statementsTerms and Conditions■ Funding amounts: $25,000 - $15,000,000

■ Repayment Types: daily, weekly, bi-weekly, monthly, bi-monthly

■ Payment types: ACH

■ Repayment duration: 3-36 month

■ Tax liens: OK

■ Past bankruptcy: OK if discharged or dismissedGeneral Information■ No minimum FICO score

■ Credit pull: soft

■ No cost to apply

■ Most loan products are UNSECURED, with the exception of equipment loans

■ No collateral required

■ Full suite of over 20 financial lending products available

■ Revenue and credit based products available

■ Home-based, online, LLC, sole-proprietorship, and partnership: OK

■ High risk: OK (Transportation, grow house, etc)

■ Citizenship: USA (Permanent residents considered.. up to $50K max)

■ Business must be US based

■ No industry restrictions

■ Loan positions we fund: 1st-6th

■ DocuSign contracts available

■ Available in all 50 states

■ Businesses must be able to handle multiple payments to us each month

■ Robust cash flow required with no credit score

■ The expense (Interest or factor rate) of the loan is a tax write-off

Equipment FinancingWe know what entrepreneurs value the most in the equipment financing space. That's why we now offer a boutique financing arm of our company, the equivalent to that of a large scale firm.Equipment financing refers to a loan used to purchase business-related equipment, such as a restaurant oven, vehicle or copy machine.When you take out an equipment loan, you'll make periodic payments that include principal and interest, over a fixed length of time.Serial numbers, vendor purchase orders, quotes and photos of the equipment you're purchasing are required prior to funding and the equipment you purchase will be used as collateral for the loan.Additional information/ advantages of our equipment loans:

* 60 month terms available

* Favorable approval rates on complex industries

* Customized programs available for clients with A-F credit

* Hassle free application process.

* Funding amounts from $20,000 - $5,000,000

* Qualified Industries: Medical, Dental, Excavation, Restaurant, Manufacturing, Automotive

* Competitive "bank-type" rates for A+ credit: starting at 7.50%

* Same-day funding available

* Access first-to-market products and a competitive advantage

* Equipment loans are typically managed and serviced in-houseFor our preferred industries, we can offer low down programs which are determined by the quality of the equipment and strength of the business.Below is a sample list of equipment available for finance:

* Restaurant equipment

* Heavy Machinery

* Green tech equipment

* Commercial, Garbage, Box Trucks

* Construction Equipment

* Manufacturing and Retail Equipment

* Hospital and Dentistry Equipment

* Medical

* Logging

* Woodworking